does banks in malaysia provide lease financing

Overview of Banks in Malaysia. For example a sale price based on a profit rate of 9 but the seller agrees to provide a discount of 3 on the sale price based on certain scenarios eg.

Bank Instruments Providers Genuine Bank Guarantee Providers Bg Sblc For Lease

PLN 1038 million 2017 Total assets.

. Banks in Malaysia some of which are the largest in Southeast Asia offer a comprehensive range of banking and financial services. The group provides a wide range of banking and financial solutions including retail corporate and investment banking leasing factoring insurance wealth management corporate finance and advisory services. We offer a wide variety of services in response to the diverse needs of customers.

Car house as collateral in case you cannot repay your loan. Financial lease Ijarah Muntahia Bittamleek The evolution of modern Islamic banking and finance has. Every bank offers unique products and services so its always best to compare the personal loans available across the market before deciding on the one that suits your needs best.

Head over to the provider page for a full list of banks. There are five main contracts in Islamic finance. However these entities are highly regulated by the Bank Negara Malaysia BNM and are known for imposing strict lending requirements.

Maybank Malayan Banking Berhad Bank. In Malaysia commercial and industrial banks are the main providers of business loans. All your banking questions about credit cards debit cards personal loans home loans car loans savings and investment are answered in our comprehensive articles.

The leased assets will remain with the bank at the end of the lease period. We cover specific types of machinery or equipment with a specific agreement with a blanket limit as opposed to a specific limit. Banks have immense monetary assets and subsequently are dominant players in all sectors of financial markets like credit cash securities foreign exchange and derivativesCommercial banks have a critical part in the general financial position of the economy as they give assets to various purposes and additionally for various durations.

How To Guides Get the most out of Malaysias banks and finance companies when you. An asset financing facility to finance the Act Goods covered under First Schedule of Hire Purchase Act 1967 subject to the Banks discretion for business use permissible under Shariah. For Islamic banks to a make profit and to satisfy the borrowers needs of cash they have to conduct transactions that do not violate Islamic rules by looking for allowed contracts that can achieve the required goal.

Leasing is used to finance machinery automobiles and equipment in agriculture. In Islamic finance al Ijarah usually refers to a leasing contract of. Image via Freepik 18.

The guideline on Ibra therefore. Conventional Bank treats money as a commodity and lend it against interest as its compensation. AB-i Sales The AB-i Sales which is under Bai Al Dayn sale of debt is a facility where the expoter is able to obtain immediate funds from the.

Ijarah literally to give something on rent is a term of Islamic jurisprudence and a product in Islamic banking and finance resembling rent-to-ownIn traditional fiqh Islamic jurisprudence it means a contract for the hiring of persons or services or usufruct of a property generally for a fixed period and price. In other words operating lease is not preceded by a promise to lease or the concept is not based on prior promise. In a country with a more developed financial system financial institutions also offer more complex and innovative financial instruments to farmers and entrepreneurs such as leasing and factoring.

Maybank is the largest financial institution in Malaysia with 393 office and 2500 auto teller machine across the country. It refers to a leasing contract which ends with transfer of ownership of the leased goods from. Enjoy competitive rates and a margin of financing of up to 100.

Therefore the customer buyer is paying profit for 6 where he enjoys the rebate of 3. Good payment record or low funding cost Base Financing Rate. PLN 19422 billion 32021 ING Bank Śląski.

If a corporate opts in for a loan or financing repayment deferment package would it still be able to get new financing from banks. Finance Leases and Installment Sales. In Conventional Banks almost all the financing and deposit side products are loan based.

The countrys financial institutions are governed by the Bank Negara Malaysia which was established in 1959. The owner of the asset is known as lessor and the user is called lessee. Make payment easily through any CIMB.

In operating lease the bank may already own a property which it wants to lease it out. Any loan given by Islamic Banks must be interest free. Secured loans are where you are required to offer an asset eg.

It serves as the countrys central bank responsible for promoting. Almost all of the trusted banks in Malaysia offer personal loans to its customers. Mostly they are based on sale and purchase transactions accompanied by a degree of risk.

Get a utilisation period of one year and renew it without any charge on the portions you have not used. This means that the lender has a legal right to seize the asset you listed in the event you cannot repay your loan within the agreed repayment terms. Maybank offer both conventional and Islamic personal financing scheme to.

Islamic Banks recognize loan as non-commercial and exclude it from the domain of commercial transactions. Besides home loans such financial institutions offer business loans education loans and personal loans among many others. It is based on Shariah concept Ijarah Muntahiah bi Al-Tamlik.

Non-Banking Financial Companies also provide loans for those seeking finance for a home purchase. No this is only applicable to loans or financing offered by financial institutions regulated by Bank Negara Malaysia namely banks and development financial institutions. The number of individuals opting for such loans through NBFCs has increased.

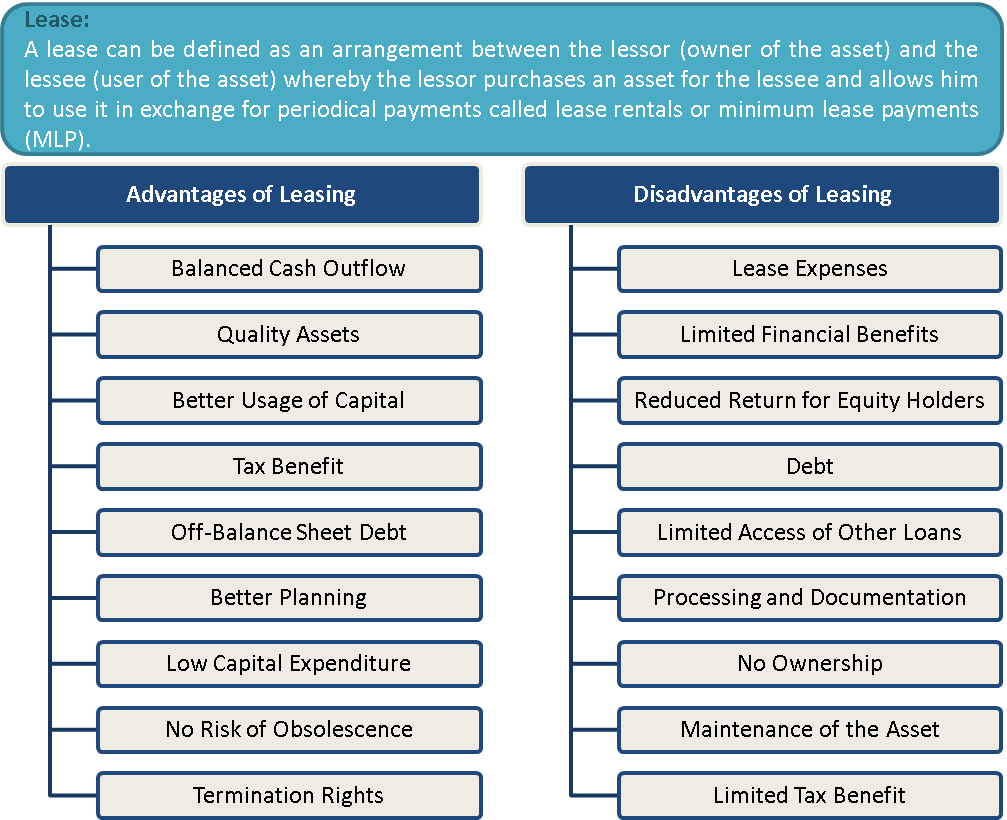

Lease financing is one of the important sources of medium- and long-term financing where the owner of an asset gives another person the right to use that asset against periodical payments. Anticipating the needs of each era SMFL is dedicated to contributing to society by providing high-value-added services. Separately companies and businesses carrying on business in Malaysia other than those in the Labuan IBFC see Question 3 are also generally subject to the regulatory supervision of the Companies Commission of MalaysiaSince the 1990s banks in Malaysia except international Islamic banks and Labuan banks have had to carry on banking business.

AB-i Purchase Under the Murabahah cost plus or mark up sales concept AB-i is a facility granted to the importer to finance the purchase of trading goods confined to halal and Shariah compliant only which include raw materials. Such as the World Bank and IFAD.

What Is Bank Guarantee Bg And How It Can Be Used Bank Financial Instrument Financial Institutions

Al Kareem Motors Bank Leased Cars 66 Main Road Samanabad Lhr Home Facebook

What Should Banks Do With Their Branches

Ifrs 16 Leases Impact On Financial Institutions Kpmg Switzerland

What Is Leasing Advantages And Disadvantages Efinancemanagement

Freehold Vs Leasehold Freehold Home Buying Tips Common Myths

Sample Lease Expiration And Renewal Letter Standard 2 Lettering Lease Letter Form

0 Response to "does banks in malaysia provide lease financing"

Post a Comment